The Chinese stock market saw the biggest price rally in almost 16 years in the last week.

During the trading week, mainland China’s CSI 300 index rose as much as 15 percent, which is the largest weekly increase since 2008.

In Hong Kong, the Hang Seng index gained more than 13 percent during the stock market week. At the same time, it closed at its highest level in 19 months.

China’s stock market was boosted by the large-scale stimulus measures announced on Tuesday, which aim to lubricate the squeaky wheels of the country’s economy. The 2008 exchange rate rally was also underpinned by extensive stimulus measures to respond to the global financial crisis at the time.

In practice, China is accelerating its economy by easing the situation in the housing market and easing monetary policy. The country’s real estate sector in particular has been depressed for four years.

There will be no trading in China’s stock exchanges next week due to a local holiday. It remains to be seen whether the positive mood seen this week will continue even after the off week.

As soon as Monday, however, China’s September official and Caixin industrial purchasing managers’ indices will be available.

Economic problems

According to its official growth target, China aims for an economic growth of five percent during the current year. However, many forecasting institutions and banks have considered this to be overoptimistic. For example, an investment bank Goldman Sachs estimates that the economy will grow by 4.7 percent.

OP: n Asset management strategist Jussi Hyöty reminded Kauppalehti earlierthat the Chinese economy has drifted into a deflationary situation. Deflation is accompanied by widespread downward pressure on prices.

According to him, a deflationary economy includes five components: an asset value shock, a collapse in consumer confidence, debt repayment, a fall in prices, and an escape to long-term interest rates.

In the case of China, you can draw a cross in every square.

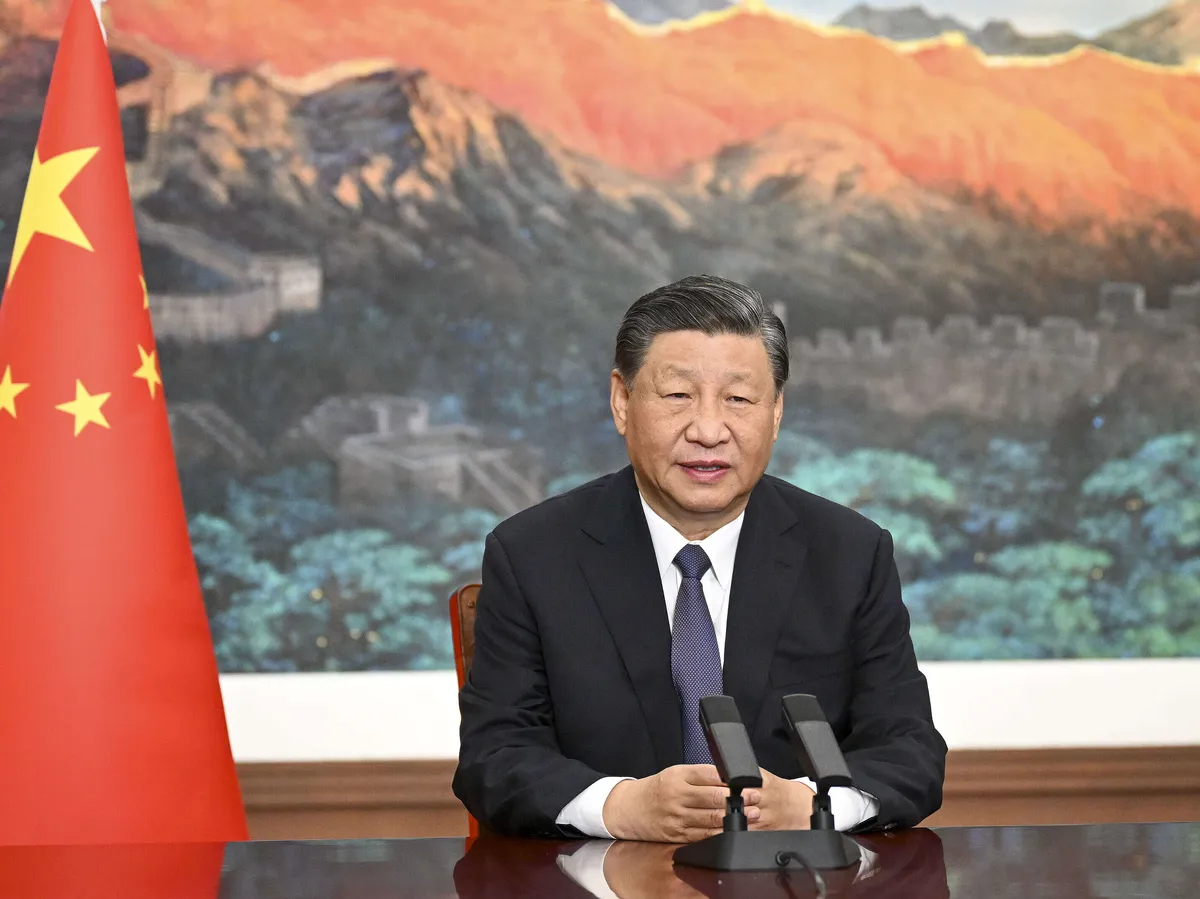

The country’s president Xi Jinping the main problem has been weak consumer confidence, which is strongly linked to the country’s housing market problems. It is estimated that up to 70 percent of the wealth of Chinese households is tied up in apartments.

Last month, in order to fix the housing market, there was a significant game movement when it was announced that the central government would dismantle the price control for new apartments. In practice, this means that the prices of new apartments are now allowed to fall more freely.

Even though housing prices have been falling for a long time, the price control of new housing has prevented the market from functioning effectively, i.e. despite the long downward trend, housing price correction has fallen short due to regulation.

Weak consumer.

As a result of the housing market crisis, the wealth of Chinese households has weakened, which has lowered consumer confidence in the economy.

PHOTO: ALEX PLAVEVSKI

A boost to credit demand

As a stimulus measure, China’s central bank lowers its own interest rate and will demand less cash from banks in the future. The cash reserve requirement is relaxed by 0.5 percentage points, which increases commercial banks’ assets by an estimated over 127 billion. In yuan, the amount is about one thousand billion.

For banks, this opens up the opportunity to lend companies more money. It is also planned to increase lending to state-owned companies so that they can buy unsold apartments. It is hoped that this will improve the housing market and consumer confidence.

The Chinese economy has indeed been described as being in a debt-deflationary situation: companies and households have taken on so much debt that instead of investing and spending, they focus on reducing their debts prematurely.

Distrust in China’s economy has also been seen as a flight to long interest rates. During the summer, for example, the country’s 10-year government bond fell to its lowest level in 20 years. Last week, market interest rates picked up, but are still historically low.

At the end of Friday, the interest rate on the 10-year government bond was at 2.18 percent, while at the beginning of the year it was still largely above 2.5 percent.

A milestone of sorts may soon be upon us, as the 30-year market rates in China and Japan have developed in completely opposite directions. Currently, China’s government bond is at around 2.3 percent, while Japan’s equivalent is at 2.1 percent.

The interest rate differential is the lowest it has been in about two decades.

“The narrowing of the interest rate differential is the result of growing optimism that Japan can escape its three decades of stagnant economic growth, combined with increasing pessimism about China’s medium- and long-term prospects,” said Duncan Wrigley, Pantheon Macroeconomicsin China’s chief economist, according to Bloomberg.

Betting on sports with bitcoin

The Ultimate Guide to the Best Bitcoin Sports Betting Sites

Best Bitcoin Sports Betting Sites for Enthusiasts

Why choose bitcoin for sports betting

Best bitcoin sports betting sites

Top bitcoin sports betting sites for 2024

Top Bitcoin Sports Betting Sites for 2024

The Ultimate Guide to the Best Bitcoin Sports Betting Sites

Top bitcoin sports betting sites for 2024

Top Bitcoin Sports Betting Sites in 2024

Sports Betting with Bitcoin

Best Bitcoin Sports Betting Sites for Your Next Bet

Sports betting with bitcoin

Top Bitcoin Sports Betting Sites for Enthusiasts

Certificate verification problem detected

Sports Betting with Bitcoin

Sports Betting with Bitcoin: A New Era of Wagering

Top Bitcoin Sports Betting Sites

Top Bitcoin Sports Betting Sites: Your Ultimate Guide

Top Bitcoin Sports Betting Sites for 2024

The rise of sports betting with bitcoin

The ultimate guide to the best bitcoin sports betting sites

http://www.neukoelln-online.de

Sports betting with bitcoin

Revolutionizing Wagers: Sports Betting with Bitcoin

Sports Betting: How Bitcoin is Changing the Game

Bitcoin in Sports Betting: A New Era

Sports Betting with Bitcoin

Sports betting with bitcoin

Bitcoin in Sports Betting