By transferring the casual clothing company into the hands of a foundation and an environmental protection organization, Chouinard also managed to avoid the considerable inheritance and real estate taxes of the generational change, Bloomberg news agency estimates.

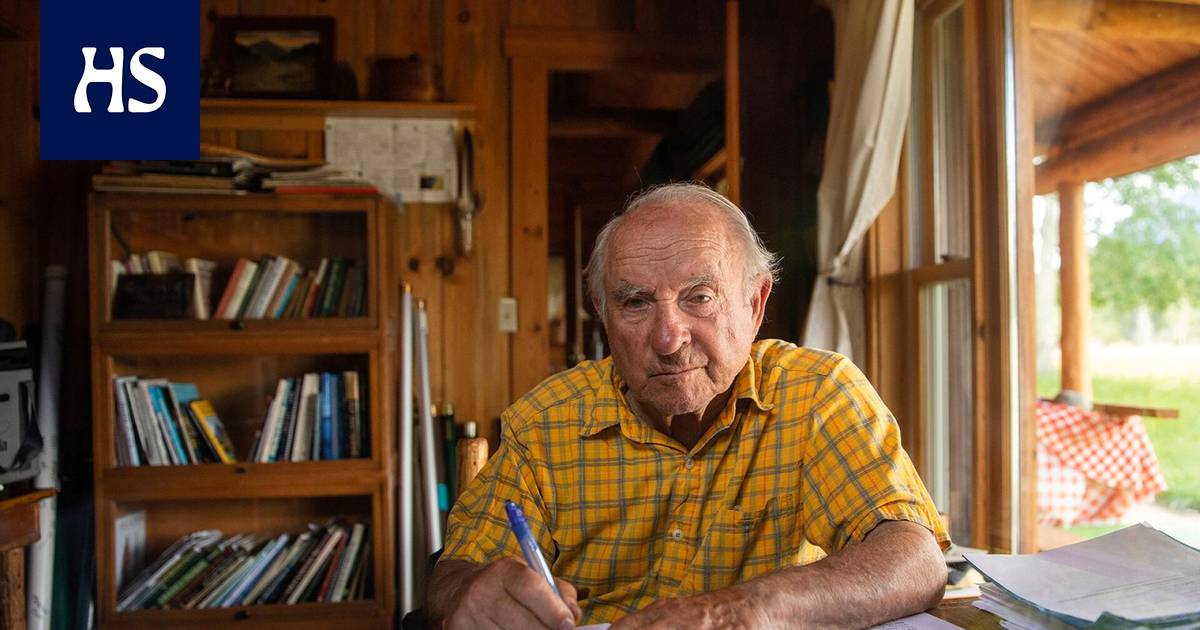

Patagonian founder Yvon Chouinard83, said this week that he has decided to put his leisurewear company in the hands of a foundation and a non-profit organization.

Chouinard said that he considered the solution to be the best way for his family to participate in saving the planet.

According to the announcement, Chouinard and his family will give up their holdings worth three billion dollars. The goal is to allocate the entire company’s profits to environmental work, Chouinard said.

“Hopefully, this will affect a new form of capitalism that ends up with a different outcome than where we just have a few rich people and a bunch of poor people,” Chouinard said, according to The New York Times in the interview.

Read more: The founder of Patagonia gave up his company and gives around 3 billion euros to the fight against the climate crisis

News agency Bloomberg’s by Tax planning can also be behind an unselfish ownership arrangement.

By transferring ownership to the fund and the organization, Chouinard avoids capital gains taxes on $700 million.

At the same time, Patagonia remains largely under family control with the help of a trust arrangement, and the heirs avoid inheritance taxes, Bloomberg estimates.

The New York Timesin I estimate according to the outdoor clothing company Patagon is a company worth three billion dollars, with an annual profit of around one hundred million dollars.

In the ownership arrangement, the company’s new main owner Holdfast Collective received 98 percent of the company’s shares. It is committed to using all of the company’s profits for the fight against climate change and environmental protection.

The remaining two percent of the shares are covered by the voting shares of the Chounard family. They will be transferred to a foundation called the Patagonia Purpose Trust.

According to Bloomberg, Chounard did not maximize his tax deduction rights when he founded Holdfast Collective. That collective has been established as an organization that is allowed to make political donations freely.

The tax deductibility of donations given to such organizations is limited.

On the other hand, they give the organization’s management more room for maneuver in terms of political influence.

Bloomberg’s according to calculations, Patagon’s founder will have to pay $17.5 million in gift tax when he transfers his voting shares to the ownership of the foundation to be established.

On the other hand, this way the Chounard family does not have to pay a capital gains tax of about 700 million dollars, which it would have had to pay if the company had been sold for 3 billion dollars.

The ownership arrangement also helped Chounard’s heirs avoid property and inheritance taxes of up to 40 percent that they could have had to pay in connection with the company’s generational change, Bloomberg estimates.

”Chounardin at no point has the family instructed us to avoid taxes,” a Patagonia spokesperson Corley Kenna said to Bloomberg when talking about the taxes paid by the company.

According to him, Patagonia has a long history of paying taxes.

The company has also pushed for corporate tax increases that could “help the planet.”

He also recalled that Patagonia’s CEO was supported by the president Joe Bidenin project to raise the corporate tax rate.