The assets of the two founders of Kingston increased by nearly 14 billion USD thanks to the booming demand for AI and the thirst for memory chips.

David Sun and John Tu, co-founders of Kingston Technology, are among the biggest beneficiaries of the wave of global AI infrastructure investment. According to the Bloomberg Billionaires Index, each person has increased their total asset value by nearly $14 billion since the beginning of January, equivalent to an increase of 44%.

With $45 billion each, Sun and Tu ranked 45th and 46th, respectively, on the list of the world’s richest people. Their wealth expansion rate this year is second only to Elon Musk (Tesla and SpaceX), Michal Strnad (Czechoslovak Group) and Carlos Slim (Mexico), and surpasses the $13 billion increase of members of the Walton family, Walmart heirs.

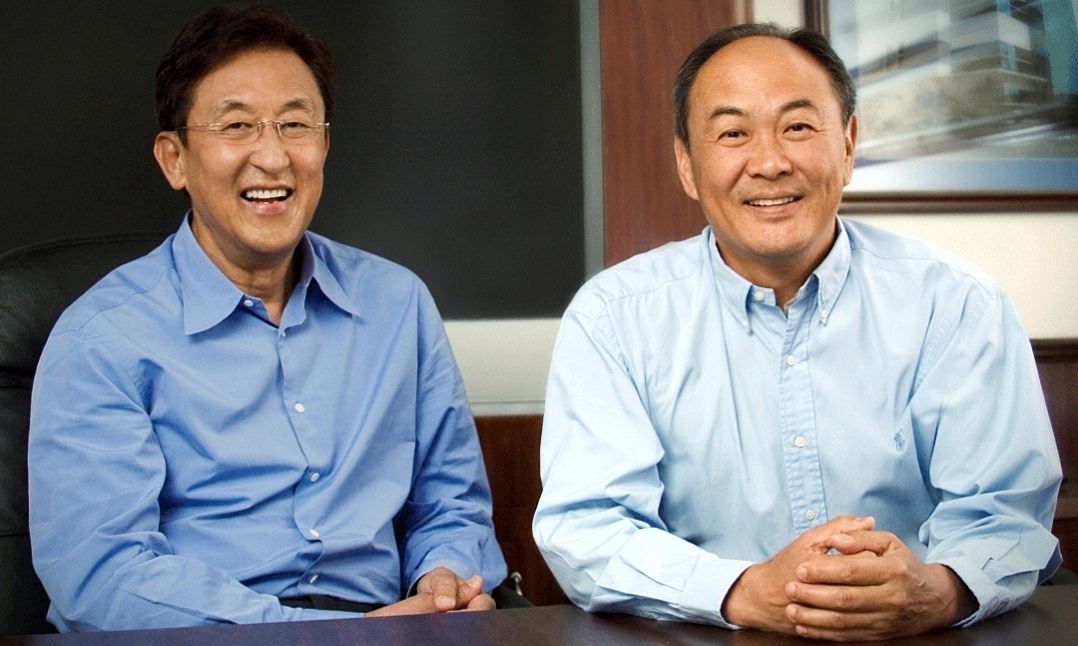

Founders John Tu (left) and David Sun (right) of Kingston. Image: Kingston Technology

Mr. Sun, 74 years old, was born in Taiwan, and Mr. Tu, 84 years old, was born in China. Both studied electrical engineering and settled in the US in the 1970s. They met in Los Angeles and became friends through basketball before starting a business together.

In 1982, the duo founded memory equipment company Camintonn and sold it four years later for $6 million. After losing all their savings in the 1987 market crash, they started up again and founded Kingston Technology.

In 1996, Sun and Tu sold 80% of Kingston shares to SoftBank for $1.5 billion, before buying back these shares for $450 million in 1999. They now each own 50% of the company. Sun holds the role of executive director of operations, while Tu is President and CEO of Kingston.

Kingston Technology is a company operating in the field of manufacturing and distributing memory and data storage devices for computers and data centers, as one of the world’s largest third-party suppliers of DRAM modules and SSD drives. This business also ranked 27th in the list of largest private companies in the United States, ranked 28th in the list of largest private companies in the United States. Forbes. The company has about 3,000 employees, and revenue in 2025 will reach 14.4 billion USD.

Market demand increased sharply when technology corporations operating large-scale data centers (hyperscalers) massively sought to buy memory chips to invest in AI data center infrastructure, leading to a serious shortage of memory chips globally and pushing prices up sharply.

This development is okay Business Insider described as a “memory super cycle”, boosting the revenue and profits of memory companies, thereby causing stock prices to rise. The market context helps Kingston benefit, dragging down the share value and assets of the two founders.

https://kanban.xsitepool.tu-freiberg.de/s/S1lTGyDDWl

https://pad.keks.cloud/s/1MMclZLa0

https://www.penana.com/user/329157/tamaradgwiggins

http://uchkombinat.com.ua/user/warloaf2/

https://hedgedoc.schule.social/s/Xn_ezh4C5

https://mootools.net/forge/profile/PranavdgWise

https://hedgedoc.sysnove.net/s/AEJ6bF-PE

https://participa.gijon.es/profiles/mejores_sitios_para_/activity

https://hedgedoc.eclair.ec-lyon.fr/s/XuLxJBO9J

https://acikveri.bizizmir.com/es/user/clinicboost

https://mediasuitedata.clariah.nl/es/user/clinicboost

https://prosmart.by/user/brakefreon98/

https://pad.riot-os.org/s/sxhV903V6S

https://jbcasinobe.com/login/

https://lovewiki.faith/wiki/Spina_dorsale_dellEuropa_dellEnergia_Solare_Esattamente_come_i_Grossisti_PV_stanno_Modellando_il_Potenziale_dellPotenza

https://hedgedoc.thuanbui.me/s/SrFCuFyu1

https://pinco-ca.net/pinco-lucky-streak-3/

http://www.effecthub.com/people/AlainadgMccormick

http://hikvisiondb.webcam/index.php?title=kincaidmcpherson0717

https://www.qnapclub.es/member.php?action=profile&uid=7921

http://exploreourpubliclands.org/members/fowltouch89/activity/1143324/

https://md.freiheitswolke.org/s/ymZtNaOEN

https://pad.darmstadt.social/s/TEx0PeG19O

https://hackmd.diverse-team.fr/s/rJbOIqkDWe

https://archeter.co.uk/user/profile/398733