Asian stock markets were in a mixed, but bearish mood on Thursday. The Asia Dow index was down 0.1 percent.

In Japan, the Nikkei index was barely in the green and the broader TOPIX index was in a gentle decline. Of the industries, utility services were clearly the weakest with a 1.3 percent slide. The daily consumption and health care sectors were the only sectors in the TOPIX index to rise.

The CSI 300 index of large Chinese companies was down 0.8 percent and the Hang Seng index of the Hong Kong stock exchange was down 1 percent. Hong Kong saw a buoyant listing when Horizon Robotics started with a 38 percent increase on the stock market lists. The news was seen as a good sign of the mood in the IPO market.

Elsewhere in Asia, we mostly saw a broad, gentle exchange rate decline.

“The Asian markets are in a fluctuating mood, but there is concern in the market as the US elections approach. The recent strength of the dollar and the rapid rise in US government bond market rates keep risk appetite in the region at bay”, IG Asia Pte:n market strategist Jun Rong Yeap commented to Bloomberg.

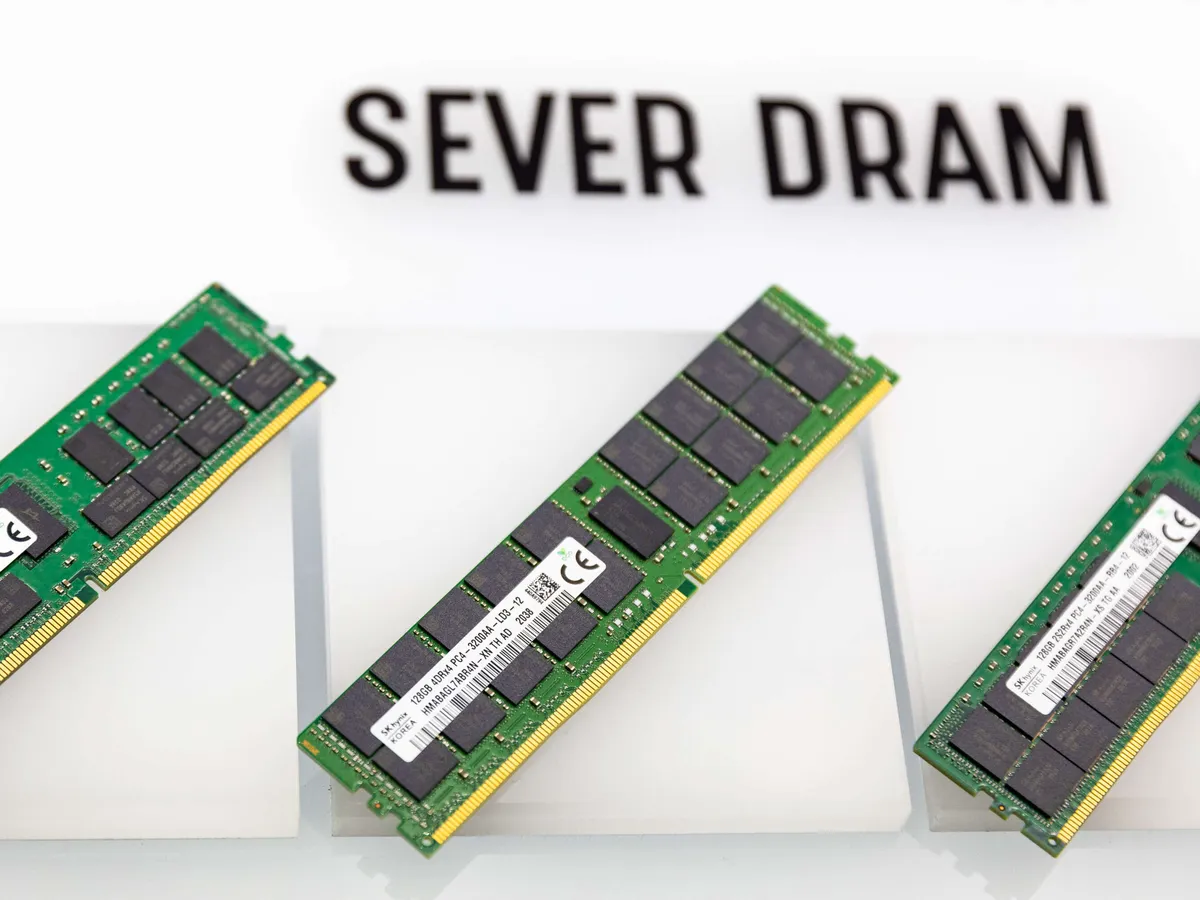

A Korean memory chip company SK Hynix was up two percent after the company reported record revenue and profit in the previous quarter. In the background there is a strong permanent artificial intelligence boom, which also increases the demand for the company’s memory chips. The company also clearly anticipates a double-digit growth rate for next year in memory chips as demand returns even outside the artificial intelligence boom in the semiconductor sector. SK Hynix is currently neck and neck in capitalizing on the AI boom among the big three memory chip companies. The other two big players are Korean Samsung and American Micron.

In the foreign exchange market, the yen strengthened against other major currencies after yesterday’s sharp decline. The yen had strengthened by 0.3 percent against the dollar and the pound and by 0.2 percent against the euro.

You got 1.079 dollars for the euro and 152.26 yen for the dollar.