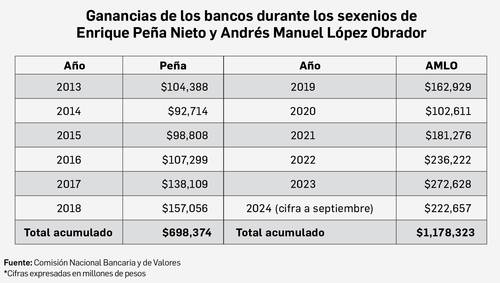

The group of private banks operating in the country increased their profits by 68 percent during the six-year term of President Andrés Manuel López Obrador, when compared to those obtained in the government of Enrique Peña Nieto, data from the National Banking Commission and Securities (CNBV).

From January to September of this year, these private financial institutions, the majority of foreign origin, earned 222,657 million pesos, a figure 8.3 percent higher than what was reported in the same period of 2023.

With this result it is possible to calculate the profits accumulated during the six-year term of President López Obrador, which ended last September.

In this way, between 2019 (AMLO’s first full year) and September 2024, the banks’ accumulated profits totaled one trillion 178,323 million pesos, the highest in history.

Between 2013 and 2018, the period that frames the six-year term of President Enrique Peña Nieto, banks obtained profits of 698,374 million pesos, according to official figures from the CNBV.

The above means that profits in said period increased by 68 percent in nominal terms (without discounting inflation).

It should be remembered that during the López Obrador government, specifically in 2020, an economic and health crisis was generated due to the covid-19 pandemic.

It also highlights the fact that last year the reference rate of the Bank of Mexico (BdeM), which is the instrument that sets the cost at which companies and families are financed, reached a level of 11.25 percent, the highest since The central bank has the goal of controlling inflation through monetary policy.

The above allowed banking institutions operating in the country to consolidate their best year in terms of profit generation, and the amount of their profits closed 2023 at 272,628 million pesos.

The result as of September of this year is also the best for a similar period since it was recorded by the CNBV; However, the growth rate is lower than that reported in 2023, when profits increased 17.2 percent.

The seven banks of systemic importance (those that, in the event of bankruptcy, would put the stability of the Mexican financial system at risk), which are BBVA, Santander, Banorte, Citibanamex, HSBC, Inbursa and Scotiabank, concentrated 80 percent of the profits until September 2024, with a sum of 178 thousand 578 million pesos.

Greater financial margin and lower defaults

The financial margin, which mainly results from the difference between the interest charged to debtors and those paid to savers, reached 634 thousand 103 million pesos, an amount 13.2 percent higher than the 560 billion pesos reported from January to September 2023.

In this sense, interest income totaled one trillion 325 thousand 561 million pesos, an amount 11.8 percent higher when compared to what was reported as of September 2023, which was one trillion 184 thousand 704 million pesos.

For its part, interest expenses amounted to 691,458 million pesos, while a year ago the figure was 624,703 million pesos, which represented an increase of 10.6 percent.

According to statistics, the balance of the total credit portfolio stood at 7 trillion 341 billion pesos, an amount 10.4 percent higher when compared to the 6 trillion 658 thousand 265 million reported until September 2023.

The delinquency rate stood at 2.06 percent, which implied a decrease of 0.09 percentage points compared to the 2.15 percent reported in September of last year.