Chip company Nvidian Once again, high expectations have been downloaded for Wednesday’s earnings announcement.

Production problems, demand decline, or, in the worst case, both would probably be disappointing at the same time.

The California company is an accelerator and enabler in artificial intelligence development with its efficient graphics processors (GPU), which are used in data centers and has been scored by other technology companies with billions and billions of dollars.

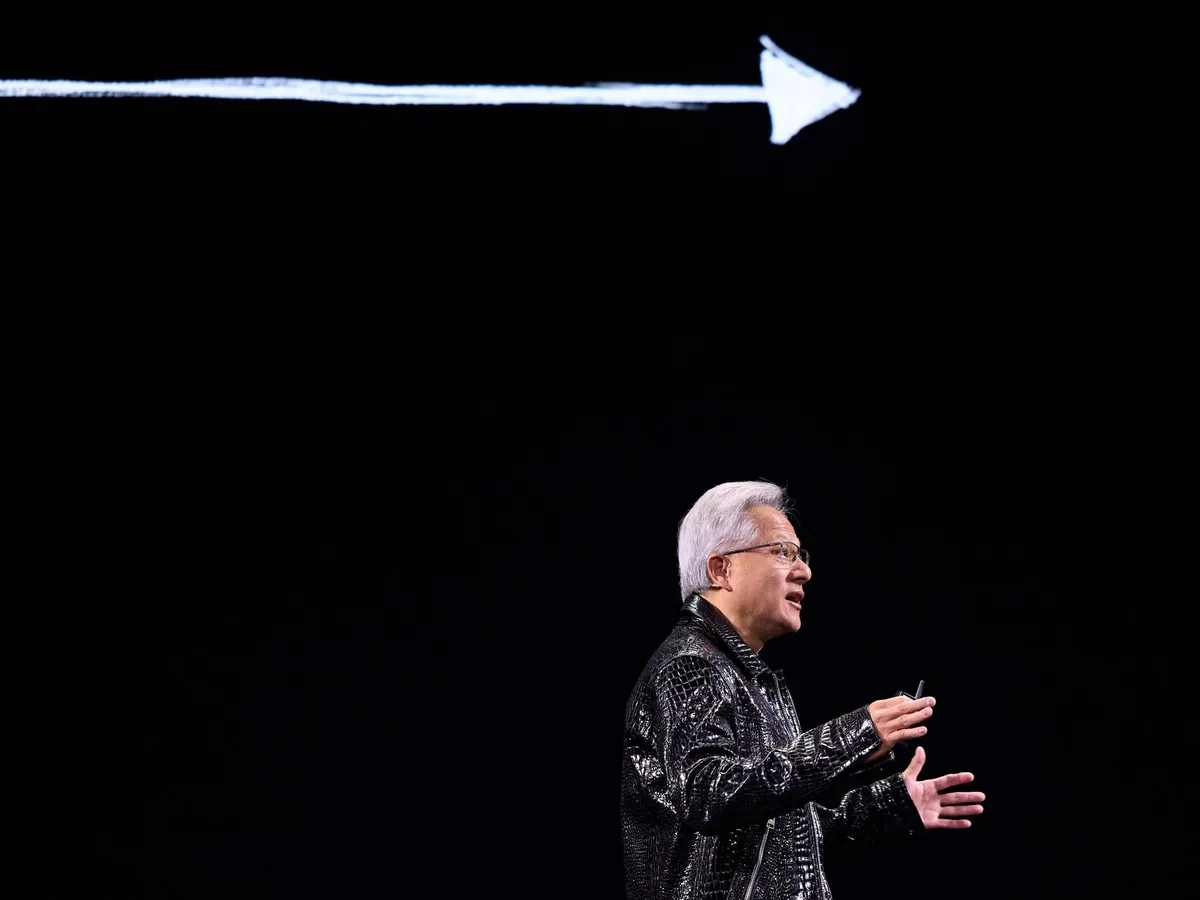

Now the key questions are related to the company’s new Blackwell architecture. In November, Nvidia said it was waiting for Blackwell exceeding Previous predictions of ‘several billion dollars’ revenue. Managing director Jensen Huangin According to the Blackwell production is full in a pace. At the latest, the analyst calls on what the situation is right now and whether high expectations are being overcome.

Huang is expected to shed light on the prospects for artificial intelligence in the longer term.

At the end of January, the market was strongly responding to Chinese Deepseek-tartup to produce surprise. Deepseek claimed to have developed a competitive artificial intelligence application for Chat GPT with cheap Nvidia chips. The news made the investors consider whether the demand for effective and expensive artificial intelligence is as strong as previously anticipated.

Monday US Marketwatch toldthat in data centers and artificial intelligence big investment Microsoft would have terminated two of their lease related to data centers. According to CNBC, the company says it is still committed to its investment plans, but the infrastructure accommodation In some areas it is possible.

Nvidia will announce its four -quarter and all -year result on February 26, after the Wall Street Stock Exchange Closed.

The expectations of analysts

Information service Factsetin According to analysts, NVIDIA expects to increase its fourth quarter net sales to $ 38.2 billion from a year ago from $ 22.1 billion.

Net sales of a very important data center segment to the company will be expected to reach $ 33.6 billion from $ 18.4 billion.

Analysts predict NVIDIA’s operational operating profit to increase to $ 24.6 billion in reference period from nearly $ 14.8 billion (non-GAAP). Earnings per share are expected to have resulted in $ 0.84.

According to Factset, the average recommendation of 50 analysts for Nvidia’s share is “buy”. The target price is $ 177.03. On Monday, the share dropped by three percent to $ 130.28. Over the past 12 months, the share has strengthened about 65 %.